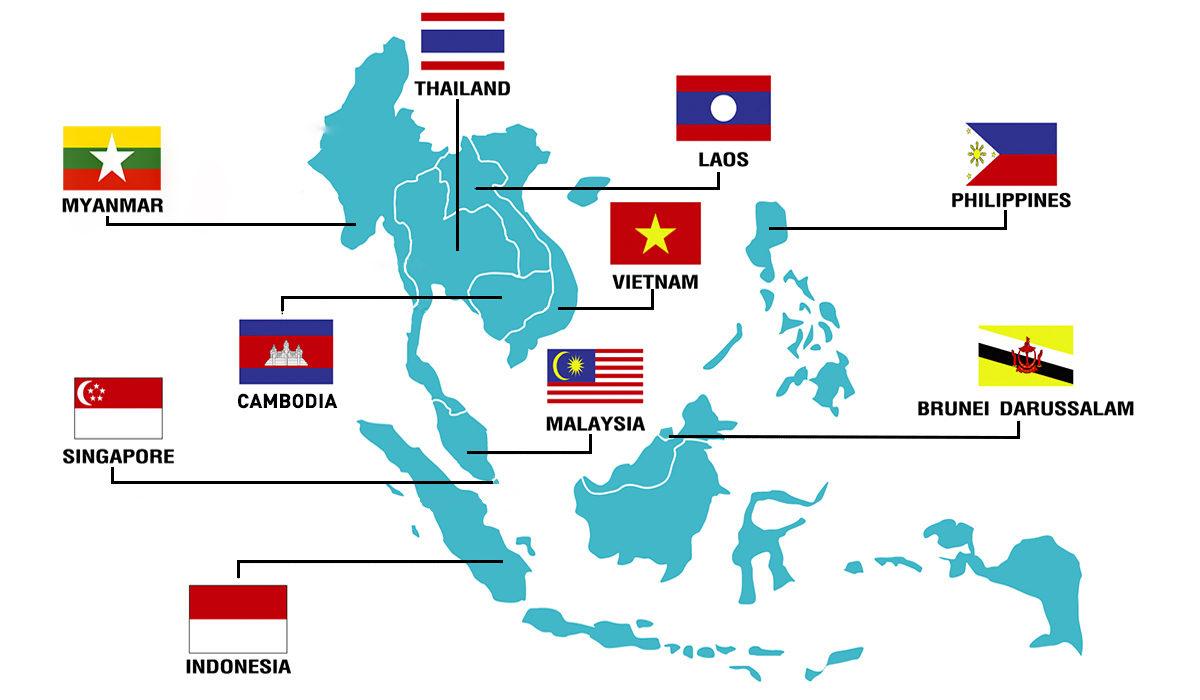

Cambodia

Cambodia

Texas’s 3rd Anniversary Celebration: 1000 Free Chicken Sets, Scratch Card Prizes, and Influencer Collaborations

In honor of Texas’s third anniversary, the brand is offering a special commemorative promotion, presenting 1000 complimentary chicken sets Read More

Indonesia

Indonesia

Sarirasa Group’s Exclusive Christmas Offerings for Limited Time Only

The Sarirasa Group, a prominent Indonesian F&B company overseeing several top-tier restaurants in the local culinary landscape Read More

Malaysia

Malaysia

Potato Corner Debuts in Malaysia Serving Flavored Fries and Chicken Pops

Potato Corner, the Filipino food franchise known for its flavored fries and chicken pop, has inaugurated its first Malaysian outlet Read More

Domino’s Pizza Malaysia Unveils Chief Spicy Officer Position Alongside Spicy Ssamjeang Pizza Comeback

Domino’s Pizza Malaysia is introducing its Chief Spicy Officer position in conjunction with the comeback of the popular Domino’s Ssamjeang pizza Read More

Philippines

Philippines

California Pizza Kitchen Expands its Global Reach with a New Philippine Store

California Pizza Kitchen (CPK) continues its international franchise growth with the opening of a new franchise location in Muntinlupa City, Philippines Read More

Singapore

Singapore

KFC Singapore Spices Up Holidays with ‘Dip ‘N Share’ Bucket and ‘You Dip, You Share’ Card Game

KFC Singapore is introducing a festive twist with the launch of its Dip ‘N Share Bucket and a limited-edition ‘You Dip, You Share’ KFC card game Read More

Halal-Certified Festivity: J65 at JEN Singapore Tanglin Wins Best Buffet Award and Unveils Delectable Christmas Spread

JEN Singapore Tanglin by Shangri-La is offering a halal-certified Christmas buffet at J65, which won the prestigious Best Buffet award in the Halal Awards 2022 Read More

Thailand

Thailand

Survey Reveals 67% of Thai Meat Eaters Plan to Reduce Meat Consumption in the Next Two Years

According to a survey conducted by Madre Brava, a science-based advocacy group, 67% of Thai meat consumers express an intention Read More

SHOW DC Elevates Shopping Experience with Food Street

SHOW DC, Bangkok’s largest outlet shopping destination, has enhanced its retail and entertainment offerings with the introduction of Food Street Read More

KFC Invests $14.2 Million in Expanding Digital Stores in Thailand

Central Restaurant Group, the entity managing KFC operations in Thailand, is set to allocate $14.2 million towards the establishment of 15-20 new KFC digital stores Read More

Vietnam

Vietnam

Sojitz acquires NEW VIET DAIRY, expanding market reach in Vietnam

Sojitz Corporation, in collaboration with Sojitz Asia Pte. Ltd. and Sojitz Vietnam Company Ltd., has successfully acquired full ownership of DaiTanViet Joint Stock Company Read More

Ho Chi Minh City’s Culinary Delights Go Global in Media Blitz

Since December 2023, the Ho Chi Minh City Department of Tourism has launched an international campaign spotlighting the city’s diverse cuisine Read More